Georgia remains a developing country even three decades after its independence from the Soviet Union and despite its strategic location and abundant natural resources. It has benefited to a limited extent from foreign investment and relatively recent free-trade agreements with the EU and China. But its full emergence as an economically and politically resilient State has been hampered by a modernization-driven development agenda and neoliberal policies, with too little regard for their social and environmental impacts in Georgia. The country also has been held back by high-pressure, counter-productive trade- and lending policies imposed by global powers such as the IMF, the EU, the United States, and China.

This study is part of the series "Shaping the Future of Multilateralism - Inclusive Pathways to a Just and Crisis-Resilient Global Order" by the Heinrich-Böll-Stiftung's European Union and Washington, DC offices.

The Covid-19 pandemic has shone a light on multiple other global crises, be they ecological catastrophes, the exploitation of labor, or the uneven distribution of power between the Global North and the Global South. The pandemic has prompted people the world over to question the logic of profit maximization and technocratic decision-making, and exposed the dangers of nationalism, though it remains ascendant. The neoliberal model – one that favors free markets and a minimal state that is hands-off on social and environmental questions – is in crisis. Rather than waste this crisis by resorting to temporary fixes, leaders on the global, regional, and local levels must work more closely with their people to effect structural change that will build their societies’ strength and resilience.

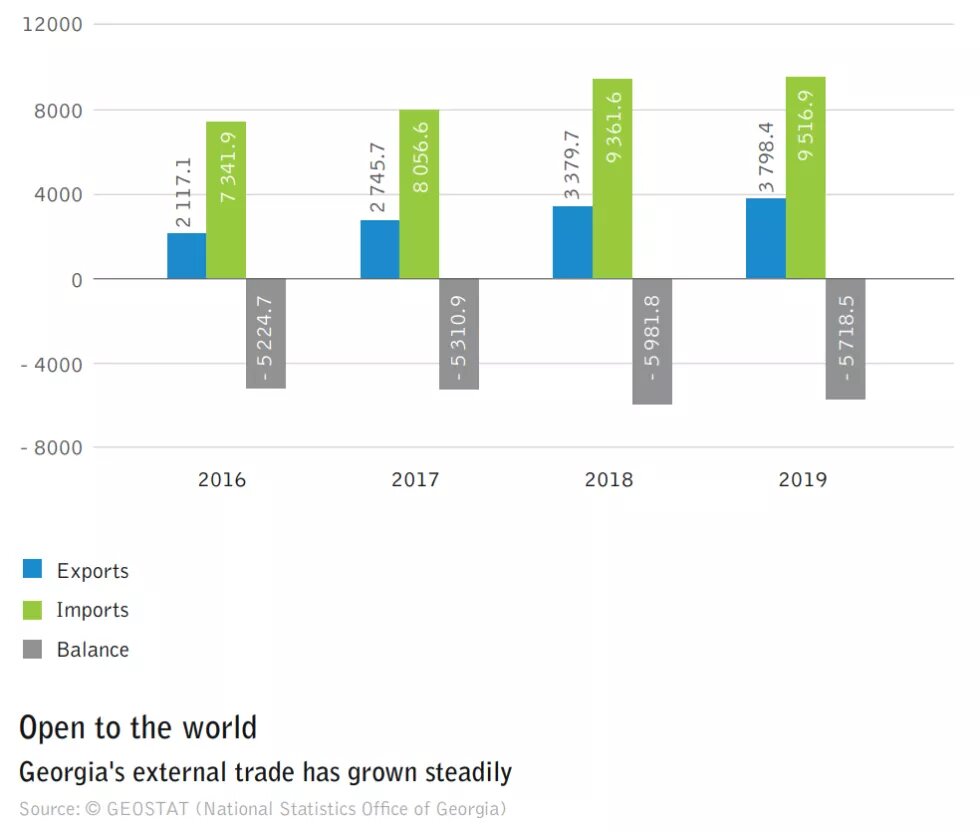

Georgia has experienced repeated political and socio-economic crises since its independence in 1991. The under-development of its manufacturing base and technology sector and its low- skilled labor force have resulted in persistent trade deficits. Trade deficit stood at -44.8 percent in 2019 (Geostat, 2021, p. 2)). Georgian exports are comprised mostly of raw materials (copper ores, ferro alloys) and agricultural products (hazelnuts, wine, citrus fruits), a structure that has not changed over the years. This has led to import dependency and the corresponding rise in foreign debt. Import dependency also has encouraged the development of a consumer economy in which consumption is mostly financed by credit and remittances. Georgia’s economy is primarily serviceoriented – wholesale and retail trade make up the largest share of GDP, at more than 14 percent. Real estate accounts for 11.5 percent, manufacturing 10 percent, construction 9 percent, and agriculture 7 percent (Geostat, 2020, p. 1).

Georgia boasts of its open economy and its free-trade agreements with the European Union (the 2014 Deep and Comprehensive Free Trade Agreement, or DCFTA), China (known simply as the Free-Trade Agreement or FTA), the Commonwealth of Independent States, and Turkey. But the country’s position in relation to its trade partners and its bargaining power with investors remain weak for a number of reasons, including its relatively small size and its dependence on foreign direct investment (FDI) for economic growth and to cover its current account deficit (National Bank of Georgia, 2018, p. 31). Foreign direct investment stood at 7,7 percent of GDP in 2019.

So the government has limited capacity to resist the loan conditionalities of global institutions, such as the International Monetary Fund (IMF) or the World Bank (WB). Georgia’s FDI led economic model draws the country into a global competitiveness struggle for foreign capital and pushes it to loosen social and environmental standards in production, such as minimum wages, overtime payments, workplace safety, and environmental protection. The post-2003 Rose Revolution governments have focused on engineering an employer- and investor-friendly labor market, at the cost of exploiting labor and the environment (Gugushvili, 2016, p. 3; Lazarus, 2013, p. 9). Death and injury of workers is not uncommon at coal mines, manganese production sites, or construction sites. Poverty, unemployment (18.5 percent), malnutrition, and income inequality remain key challenges (Gugushvili, 2016; Kakulia et al., 2017; UNICEF, 2018).

The pandemic has made these problems more visible, raising more questions than ever over social justice, environmental sustainability, and the general welfare of the populace, and highlighting the urgent need for structural change. Real GDP declined almost 6 percent in 2020. The number of beneficiaries of targeted subsistence allowances soared in the first months of the state of emergency and related lockdown in spring 2020 (Social Service Agency, 2020), as employers fired workers with no compensation. More than 100,000 people had lost their jobs as of October 2020.

Yet, the Georgian government went out of its way to sustain key export industries,[1] such as the production of coal, manganese, copper, and gold during the pandemic (Qeburia & Devidze, 2020). And the government proceeded with building hydropower stations that are broadly opposed by the public (Janelidze & Nakhutsrishvili, 2020). These actions reflect the fact that the pandemic has made Georgia even more dependent on foreign financing (National Bank of Georgia, 2020d). The increasing debt, in turn, heightens socio-economic vulnerabilities within the country and further weakens Georgia’s position in the global hierarchy.

Free-trade agreements and trade balance

Georgia continues to export raw materials and agricultural products, a sign that free-trade agreements have not contributed to the development of new sectors of the economy.

Even though Georgia’s exports have been increasing since 2017, the structure of exported goods has not changed significantly since independence, an indicator that the country’s economy is not developing. As of 2020, the key export was copper ore, which accounted for 22 percent of total exports and increased 12 percent by volume in 2020. Georgia’s top export markets overall were led by China at 14 percent of total exports, followed by Azerbaijan and Russia at 13 percent each. The biggest importers were Turkey at 18 percent of the total, Russia at 11 percent, and China at 9 percent. The top three imported products are vehicles (9.5 percent), copper ore (7 percent), and petroleum and petroleum oils (6 percent) (National Statistics Office of Georgia, 2021).

Georgia signed a free-trade agreement (FTA) with China in 2017 and joined its Belt and Road Initiative (BRI) in 2015. China is interested in Georgia due to its geographical location, even though the South Caucasus is not included in BRI routes. The Georgian government and businesses hope that the FTA will diversify the country’s export markets, leverage its geostrategic location (on the Black Sea and bordering Russia, Turkey, Azerbaijan, and Armenia), improve its political security, accelerate economic growth, increase employment, and place the country in a better position on the global market. However, China-Georgia trade relations, of course, are based on a distinct power asymmetry, considering their relative geographic and economic size.

The abolition of customs duties for more than 90 percent of Georgian goods and services under the trade agreement boosted Georgian exports to China by 113 percent in 2020 (National Statistics Office of Georgia, 2021). However, the question is what Georgia exports to China and how the FTA contributes to the development of new sectors of the economy. More than 70 percent of Georgian exports to China are copper ores and concentrates, as well as wine (10 percent). Imports from China, in contrast, are diversified: computers, tires, and flat-rolled products of non-alloy steel (National Statistics Office of Georgia, 2021). While China is successfully overcoming its middle-income trap [2] by shifting its domestic production from low value-added production and resource extraction towards the manufacturing of high-tech goods (bio-pharmaceuticals, information technology, telecommunications equipment, electric cars, artificial intelligence, renewable energy, aerospace engineering, etc.), Georgia has failed to develop such a strategy to change the structure of its economy.

Moreover, foreign firms encounter difficulties entering the Chinese market, including Georgian traders, who complain of a lack of information and clarity on procedures, especially due to varying and constantly changing rules in different provinces. Still, Georgian firms are determinedly planning to expand and export to new countries (UNECE, 2018, p. 93).

Georgian exports to the EU (21.5 percent of exports) are mostly comprised of agricultural products (hazelnuts, dried and fresh fruit, wine) and raw materials (copper ore, ferro alloys) (National Statistics Office of Georgia, 2021). Even though exports to the EU rose 30 percent between 2014, when their trade agreement began to be provisionally applied, and 2019, and the number of exporting companies increased 46 percent, there has been hardly any change during that time in the types of exports (Guruli, 2020, p. 5). The 2020 National Action Plan for the implementation of the DCFTA addresses the diversification of exports with programs for Georgian producers to participate in the European Enterprise Network and take part in industry exhibitions (“DCFTA Action Plan 2020,” 2020). But those are long-term development approaches rather than major initiatives that might have more large-scale impact immediately.

Tourism revenues (18,7% of GDP in 2019), is a linchpin for Georgia’s trade balance, offsetting some of the goods-trade deficit (National Bank of Georgia, 2021). But while the country has the potential to attract more Chinese and European tourists, the sector is vulnerable due to periodic domestic and regional instability, including with Azerbaijan and Armenia as neighbors, not to mention Georgia’s own conflicts with Russia. The pandemic has also highlighted the fragility of an economic-growth model reliant on tourism as a major sector. Yet, as the government in Tbilisi develops its pandemic recovery strategy, it is again placing significant hopes on a revival of tourism (Civil Georgia, 2020b).

Big companies in foreign ownership profit most from the FTAs, while SMEs cannot fully enjoy the benefits of free trade.

The fact that Georgia has not managed to diversify its exports or develop new sectors of the economy raises the question of who profits from the existing constellation. Between 2005 and 2012, the copper mining operations in Georgia were controlled by Stanton Equities Corporation, a company registered at Virgin Islands, a subsidiary of the Russian company Promishlenniye Investori (Green Alternative, 2013, p. 2). In 2012 RMG Gold and RMG Copper took over the gold and copper mining in Georgia. Until 2019 RMG Gold was owned by Rich Metals Group B. V., registered in the Netherlends and it is now owned by Mining Investments LLC, which is under the ownership of a Cyprus based company Pamtilon Holdings Limited Ltd. There is no publicly available information about the stakeholders of RMG Copper in the registry of entrepreneurial and nonentrepreneurial legal entities, as the Georgian law does not require the publicity of such information for joint stock companies. Yet, according to the company’s 2017 financial statement its final owners were Suncort Enterprises Limited and Ticola Holdings Limited - registered at Virgin Islands. In 2019 RMG Copper turned out under the ownership of Mining Investments LLC (Green Alternative, 2021, pp. 1-4).

Even though agricultural products have potential for exports, small- and medium-sized enterprises (SMEs) in this sector face major hurdles. SMEs play a crucial role in Georgia’s economic development, not only in terms of rural development, but also for employment. In Georgia, almost half the labor force is self-employed, and a large share of them run very small de facto enterprises (Guruli, 2020, p. 6). Most of Georgia’s agricultural SMEs struggle to meet EU quality standards due to the high costs of compliance. The small scale of production that is most common in the country makes it is difficult to reduce production costs, and expansion is hindered by the poor condition or lack of availability of infrastructure such as irrigation systems, cold-storage units, and roads. SMEs also struggle to access credit (Daghelishvili, 2019), and proper insurance packages for agricultural goods (for example for the goods sensitive to weather conditions) (Civil Society Organisations, 2018a, p. 37). Also, farmers lack adequate information about fertilizers and so too often use chemicals that damage the environment and the products themselves. The country also lacks the kinds of laboratories that producers of honey, dried fruit, tea, and hazelnuts, for example, need to conduct microbiological and chemical testing to meet EU requirements (UNECE, 2018, pp. 92-95).

A study of SMEs outside Tbilisi (Civil Society Organisations, 2018a) found that most producers are not well-informed about the DCFTA. Of the surveyed enterprises, 77 percent said they do not export their goods. Of those that do export, most shipments go to non-EU markets rather than to the EU. Even though most SMEs plan to expand their production, those not exporting to the EU do not intend to acquire the necessary certificates (Civil Society Organisations, 2018a, p. 34). Thus, small agricultural enterprises cannot profit from the DCFTA yet, even though the EU provides significant technical and financial support – for example, through the ENPARD project.

The above-mentioned challenges of SMEs also are addressed in the 2020 National Action Plan for implementing the DCFTA (“DCFTA Action Plan 2020,” 2020).

The Georgian government has established the “Produce in Georgia” and “Start-up Georgia” programs to encourage local production and the development of high-tech companies, and adopted a Legal Entity Public Law for supporting SMEs. But these projects do not cover all sectors (UNECE, 2018, p. 15).The lack of skilled labour also is a significant issue in Georgia. The agricultural sector, for instance, lacks veterinarians, agronomists, and food-safety experts (Civil Society Organisations, 2018a, p. 35; UNECE, 2018, p. 96).

Foreign investment

FDI mostly flows to construction, real estate, the financial sector, and infrastructure projects. Despite the associated economic growth it also does not always lead to tech- and knowledge transfer.

Georgia depends on foreign investment for its economic growth. Yet, sustainable development can be achieved only through a mindful allocation of investments, which would lead to knowledge and technology transfer, employment creation with fair labor conditions, and environmental protection. Unfortunately, this is not typically the case in Georgia.

Chinese companies in Georgia are represented in free industrial zones (Poti Free Industrial Zone[3]), real estate (Houaling Group), tourism (My Way airlines), the financial sector (Basis Bank), energy,[4] steel production (Rustavi Steel Corporation Company), electric-vehicle production (in Kutaisi by Changani), as well as in technological innovation[5] (Charaia et al., 2020, pp. 26-28). Despite this wide range of economic activity, Chinese investors are primarily interested in energy, real estate, infrastructure, and finance, none of which offers technology transfer.

Chinese companies are almost absent from the export sector in Georgia (Charaia et al., 2020, pp. 15-19). The Kutaisi Hualing Free Industrial Zone described by a researcher Evelina Gambino as “a large pile of plastic and scrap metal burned in an empty field where a few workers were rearranging large stacks of logs” rather than “a lively multicultural trade paradise” (2019, p. 199) represents the unfulfilled promises of Chinese investments in Georgia.

The European Union plays a significant role in the Georgian economy, accounting for 40 percent of total FDI and more than one-third of remittances (Charaia et al., 2020, pp. 15-19). Like Chinese investment, most EU inflows (US$600 million in 2019) also are directed toward real estate, the financial sector, and energy, but some of the EU investment goes toward hotels and restaurants, mining, and transportation. The EU also invests in energy efficiency (e.g. Caucasus Sustainable Energy Financing Facility, South Caucasus Sustainable Energy Finance Facility), reduction of air pollution and greenhouse gas emissions, as well as hazardous waste management, sustainable tourism, and organic agriculture. Moreover, EU grants within Georgia’s 2014 Association Agreement with the bloc are directed towards economic development, good governance, climate change, and people-to-people exchange. The EU actively supports rural development, especially with a focus on food safety, and provides assistance to bolster the export capacities of SMEs (Guruli, 2020, pp. 5-7). Thus, the investments from the EU are more likely than those from China to contribute to Georgia’s knowledge base and technology transfer.

The EU also tries to increase the access of SMEs to capital, which is a key challenge, because the channelling of capital to SMEs by the European Bank for Reconstruction and Development (EBRD) through local banks has not been very successful. SMEs struggle to present low-risk plans to the banks to receive loans at reasonable interest rates[6] (Civil Society Organisations, 2018a, p. 37), and Georgian banks also have been hesitant historically to finance start-ups and small enterprises.

Debt

The rise of the government’s foreign debt increases its dependence on global institutions and foreign development banks.

The main avenue for Georgia to cope with its current account imbalances and budget deficits is foreign financial support, creating foreign debt that makes up 79 percent of government debt. The primary lenders are the IMF (19 percent of the external debt), Germany (20 percent), France (14 percent), the Asian Development Bank (13 percent), and the EU (7 percent). While foreign loans might be the only way of tackling the socio-economic impacts of the pandemic, the biggest share of foreign borrowing funds infrastructure and energy projects. Georgia’s debt to China also is increasing, similarly to the way its lending to developing countries under the Belt-and-Road Initiative threatens to create a broader debt crisis.

Georgia’s debt to the IMF and the EU has increased during the pandemic. Credits were issued to the Ministry of Finance, the Central Bank, and the private sector (National Bank of Georgia, 2020d) (Civil Georgia, 2020a). The government has warned that debt as a share of GDP probably will reach 62 percent in 2021. While that would exceed the legal threshold of 60 percent of GDP, the law provides exceptions in the case of circumstances such of war, economic recession, or a state of emergency.

Foreign debt in foreign currency increases the vulnerability of the government, households, and local producers to exchange-rate fluctuations.

More than 90 percent of Georgia’s foreign debt is denominated in foreign currency (National Bank of Georgia, 2020c). The Georgian economy is highly dollarized[7] (the dollarization rate is 52.6 percent (National Bank of Georgia, 2020a, p. 16), which hinders the development of the local economy and wealth creation in the local currency.

Local producers and households are vulnerable to exchange-rate fluctuations due to foreign currency debt and higher prices on imported products.

Moreover, Georgia cannot use currency depreciation to boost its exports, as it would seriously harm companies and households that are indebted in foreign currency. More than 70 percent of corporate loans and 43 percent of household loans are denominated in foreign currency (National Bank of Georgia, 2020b, pp. 23, 30). The pandemic has negatively influenced the value of the Georgian currency, the Lari, and the Georgian Central Bank has been using its international reserves to avoid severe depreciation (International Monetary Fund, 2020).

Social and environmental impact of trade and investment

The production of key export goods – copper and ferroalloys – results in marked environmental damage and labor exploitation.

The production of copper ores and gold (by RMG Gold and RMG Copper) pollutes water, air, soil, and agricultural products. The companies disregard worker safety, and the production process creates health threats for the local population (Green Alternative, 2013). Moreover, in December 2014 RMG Gold destroyed a cultural heritage site – Sakhdrisi-Khachaghiani in southern Georgia to increase extraction at a gold mine. Residents of villages neighboring copper production sites have been forced at times to resettle due to health issues such as hypertension, respiratory ailments, cancer, and cardiovascular diseases that the Georgian NGO Green Alternative says are related to the mining (Green Alternative, 2010, pp. 10-13), even as the remaining population struggles with the shortage of kindergartens, schools, hospitals, and proper infrastructure (Qeburia & Devidze, 2020). In manganese production in the western Georgian city of Chiatura, the company Georgian Manganese has been fined many times by the government for its environmental damage (Green Alternative, 2018a, pp. 1-2), and workers repeatedly strike over workplace safety hazards (Khaliani & Aptsiauri, 2014; Tsuladze, 2018). The same can be said about coal mining, which is used for the production of ferroalloys (Green Alternative, 2018b, p. 3).

Capital inflow from China and the EU causes social and environmental harm in some cases.

Mistreatment of the workforce has occurred on the sites of Chinese capital investments, such as the Georgian Timber Processing Corporation and Georgian Wood & Industrial Group, subsidiaries of Xinjiang Hualing Industry and Trade Group, where Georgian workers have gone on strike over working conditions (Khishtovani et al., 2019, p. 49; Zhou, 2012, pp. 5-7).

Investment capital from the EU also is not always allocated in a socially and ecologically mindful manner. As an example, the EBRD is actively financing hydropower stations in Georgia, such as the Nenskra HPP and Shuakhevi HPP projects, that threaten to have disastrous effects on the environment and on local populations. The EBRD itself has said, for example, that the area of the Nenskra dam, which is being developed by Korea Water Resources Corporation, “is highly sensitive from both social and environmental viewpoints.“ Yet experts have raised alarms that the dams have potential systemic risks that have not been studied sufficiently. The projects usually are planned without the consent of the local population, and repeatedly prompt serious questions about their ecological sustainability and socio-economic viability. Residents near constructions sites have expressed concerns over the loss of land, lack of water for pastures, and changes in microclimates that will negatively affect agriculture.

But the Georgian government most often ignores the concerns of local residents, and at times the tensions have boiled over, resulting in clashes with police, as in the case of the Khadori 3 Hydropower Plant in Pankisi Gorge. One of the most recent projects that drew protests is the Namakhvani Hydropower Plant in the country’s northwest, a structure referred to by local residents as the “dam of death” because the plans include expropriation of land, flooding of private property, and forced resettlement of people in the area. Moreover, analysis of the government’s contract with the investor, Enka Renewables (formerly Clean Energy Group Georgia LLC, a subsidiary of a Norwegian company that also developed the Shuakhevi dam project), shows the terms overwhelmingly favor the company on land- and water-usage rights and insurance against risk (see Tsintsadze, 2021).

Implementation of the DCFTA’s sustainable-trade standards encounters hurdles in Georgia.

The 2020 National Action Plan of Georgia on implementing the DCFTA includes a section on sustainable development and trade. A section on the environmental aim of fighting wildlife trafficking, developing sustainable forest management, and adopting a new Forest Code includes implementation of the U.N. Framework Convention on Climate Change (UNFCCC) and development of a climate National Action Plan. The section on labor lists the following themes: implementation of labor standards and labor inspection, development of an operational framework on child labor, and the enhancement of nondiscrimination at the workplace, as well as strengthening the role of trade unions in consultations on labor rights (EU-Georgia Association Agreement Implementation Framework.Trade and Sustainable Development. Work Plan 2018-20, 2018). These social and environmental standards are crucial for Georgia, yet they are not always implemented in practice. Even though Georgia has created a labor-inspection regime, its implementation raises significant doubts about its effectiveness. The understanding of workplace inspection remains limited in Georgian law, focusing mainly on the physical safety of workers. The implementation of labor regulations and reform of the labor code have been largely opposed by business associations (Civil Society Organisations, 2018b, pp. 23-28).

Furthermore, Georgia in 2018 adopted an Environmental Assessment Code to comply with its EU Association Agreement. But even though this code requires public participation in the decision-making process on issues with environmental ramifications, implementation has been problematic (Civil Society Organisations, 2018b, pp. 42-43), as clearly demonstrated in the case of Namakhvani HPP.

Geopolitics of Trade

The EU and China free-trade agreements and Georgia’s quest for foreign investment have turned the country into a field for geopolitical competition for the two players and for the United States, questioning their positive impact on Georgia’s economic development and political stability.

Trade is not only about economics, of course, but also about geopolitics, in which security plays an important role. Even though Chinese-Georgian relations are predominantly economic, the FTA with China has geopolitical implications, in part because of China’s cooperation with Russia, on the one hand, and Georgia’s declared pro-Western orientation, on the other (Sirbiladze, 2020, p. 6). The BRI and the Made in China 2025 policy to accelerate China’s high-tech manufacturing sector, have alarmed developed countries, especially the United States. In addition, the EU has filed complaints at the WTO alleging China is disregarding global trade rules, and countries such as France, India, and Japan have rejected Chinese investments on geopolitical and geoeconomic grounds.

EU-China and U.S.-China clashes have played out in Georgia as well. The EBRD is not happy about Chinese companies taking over large public-infrastructure projects in Georgia such as the Rikoti tunnel, the Adjara bypass road, and the Tbilisi railway bypass, which are financed by EBRD loans (Zhou, 2012, pp. 6-7). Additionally, a Polish ambassador to Georgia recently expressed dissatisfaction with the Georgian government’s decision to employ Chinese companies instead of European competitors for projects financed by the EU. And the Georgian government is inviting Chinese companies to produce in Georgia to take the advantage of the cheap labor pool and then to export those goods to the EU under the DCFTA, essentially giving China an advantage based on a Georgian agreement with a competing power.

The deep-sea port of Anaklia, seen by Georgia as an opportunity to strengthen its economy and its security simultaneously, has generated geopolitical tensions between China and the United States. In 2016 a consortium with the participation of an American company, SSA Marine, won the bid to build the port over a Chinese led group (Power China-Hubey Honguyan Power Engineering Co., Ltd), which saw the project as a key element of the BRI. However, port construction has been suspended, because the Georgian government refused to provide guarantees against commercial risks of the project, and the investors – the EBRD, the ADB, the Asian Infrastructure Investment Bank, and the U.S. Overseas Private Investment Corporation (now the U.S. International Development Finance Corporation) – are hesitant to proceed without such insurance against financial losses. The Anaklia port project not only highlights the geopolitics of trade, but also illustrates the failure of the deregulation and privatization rush in Georgia.

Actors, platforms, and global responses

The neoliberal Georgian state fails to understand development in terms of social justice and environmental sustainability.

The underdevelopment of the Georgian economy is not purely an economic phenomenon, but a factor of politics in the broad sense. The general absence of political will, institutional capacity, or the necessary public and civil society discourse about Georgia’s development explains why Georgia has failed to break its dependence on foreign goods, capital, and currency. In the history of independent Georgia, none of its governments have crafted a sound path on which development would mean not only GDP growth, but also social welfare and environmental sustainability. Georgian governments have internalized the major claims of modernization theory[8] and operated on the belief that economic growth at any cost will bring development at some point. Yet, during the country’s three decades since independence from the former Soviet Union, their reliance on foreign capital, privatization without regard for social and environmental standards, radical deregulation, opening of the economy, disempowerment of labor, ignorance of the ecological impacts of production, and empowerment of investors and employers have failed to bring about prosperity and wellbeing for Georgian society. Civil society also has failed to effectively challenge the dominant direction of economized development and the belief in a minimal state.

International organizations increase the vulnerability of developing countries by pressuring them into throwing open their economies. The resulting debilitating debt in developing countries is alarming.

Global powers and international organizations have been the drivers and supporters of Georgia’s counterproductive policies. Georgia was forced to open its economy to foreign goods, foreign capital, and foreign currency too early in its economic transition. The country emerged into the uneven competition of the global market without its own currency, functioning institutions, or independent economic structure. The wrenching opening hindered the development of local production, national wealth creation, and capital accumulation. The competitive pressure of the neoliberal order has intensified Georgia’s quest for foreign capital and free-trade agreements since the Rose Revolution of 2003. The race to attract investment with a deregulated labor market, and disregard of environmental rules turned into the country’s blueprint for economic development. The fixation of international organizations such as the World Bank with rankings of good governance or business climate based too heavily on flexible labor standards or “easy” tax systems encouraged the Georgian government to try to make the country a pioneer in conditions that ended up doing more harm than good for its people and its economy. The power imbalance between Georgia and the global institutions like the World Bank, the IMF, and the WTO leaves little policy space for the Ministries of Economy or Finance to set their own terms. Even though those global institutions have been re-examining their policy goals and even changing them on some issues, Georgia’s economy cannot achieve fundamental change as long as most capital flows into non-productive sectors, capital account remains open, dollarization rate remains high, foreign debt increases, and SMEs lack access to capital.

Policy Recommendations

Considering Georgia’s inherent constraints of its small economic scale – and therefore limited bargaining power – as well as its politically unstable neighborhood and postindependence record of rushed and counterproductive liberalization, the following policy recommendations are aimed at developing a resilient economy and addressing the perpetual power imbalances the country encounters on the global market:

For Georgia:

- Rethink the utility of neoliberalism and a modernization-based development agenda by engaging civil society in a discourse on alternative modes of development beyond economic growth that also would consider social and environmental implications.

- Incentivize the development of specific sectors of the economy in ways that could diversify exports and increase sustainable employment, such as information technology, innovation, manufacturing, and agriculture. Possible actions include:

- Creating a development bank to finance prioritized economic sectors and SMEs, and assisting SMEs in agriculture in insuring their production risks.

- Reduce the economy’s reliance on foreign currencies to decrease the vulnerability of local producers to exchange-rate fluctuations and to enable wealth accumulation in the national currency; use currency devaluation to boost exports.

- Increase the role of the Central Bank in economic development by expanding its mandate beyond price stability aims, as “chasing” an inflation target often leads to strict monetary policy, higher interest rates, and less economic activity.

- Consider temporary capital controls to avoid capital flight.

- Design import-substitution policies to protect certain sectors of the economy from unfair competition by enhancing the government-initiated projects “Produce in Georgia,” which aims at developing entrepreneurship, and “Start-up Georgia,” which supports start-up companies financially.

- Develop vocational education programs to better match a larger portion of the labor force to existing and future markets.

- Strengthen regional economic cooperation to create a regional market and tackle shared issues of small-scale economies and weak currencies.

- Oblige investors as well as local producers to follow the Environmental Code and the existing labor laws.

- Enforce the findings of labor inspections and reform the labor law to establish the minimum wage, enforce overtime pay, and improve the conditions of parental leave.

- Strengthen public involvement in policy decisions.

- Provide sufficient information to SMEs so they can benefit more from opportunities provided by free trade.

For the international community:

- Give developing countries more power to design their economic, fiscal, and related social policies by lenders such as the IMF, so that recipients have more leeway to determine what their people need, and therefore more control over their own economies.

- Encourage more durable economic and social development in Georgia by providing greater support for educational programs, labor empowerment, and technology transfer.

- Enhance the EU’s cooperation with alternative trade unions in Georgia, which work on behalf of service-sector employees.

- Intensify EU cooperation with Georgian authorities on improving social and environmental standards in production.

- Increase EU support to local SMEs, especially by developing alternative direct-financing mechanisms that would not necessarily involve the biggest Georgian banks.

- Strengthen the civil society mechanism in the implementation of the DCFTA, to increase the monitoring- and advisory role of local civil society organizations in relation to the Georgian government.

- Enforce EBRD requirements large infrastructure projects for dialogue and consultation with local NGOs on social and environmental impacts.

- Ease IMF pressure on the inflation-targeting regimes of central banks in the Global South, and enable such countries to prioritize exchange-rate stability over price stability.

- Enhance cooperation between the EU and China on the basis of sustainable development aims that the two parties outlined in their joint 2020 Strategic Agenda for Cooperation, the guiding document for the relationship. Sustainable development is one of four categories covered in the plan.

Endnotes

[1] An economic situation where countries get stuck at a middle-income rate despite rapid economic growth.

[2] An economic situation where countries get stuck at a middle-income rate despite rapid economic growth.

[3] The China Energy Company Limited owns 75 percent of the shares of Poti Free Industrial Zone (Khishtovani et al., 2019, p. 44).

[4] Eastern Energy Corporation operates Khadori hydro power station, China nuclear industry 23 construction co ltd is involved in wind energy, China Tianchen Engineering Corporation – in thermal power stations.

[5] Financing the science techno park in Tbilisi.

[6] The same experience has been made by the German KfW in Georgia (Author’s interview with KfW representation in Georgia, 10.05.2017).

[7] Dollarization refers to the substitution of the functions of a national currency by a foreign currency. Dollarization rates is usually measured by the share of foreign currency loans and deposits.

[8] Modernization theory studies social evolution and transition of traditional societies towards modern ones. Development approaches coming out of the modernization theory have a teleological and economistic view on development, where social, cultural and political aspects are disregarded and developing countries are supposed to catch up with the western world.

Sources (In-text citation):

Charaia, V., Anguridze, O., Gulbani, S., Kurdghelia, L., Lashkhi, M., & Shatakishvili, D. (2020). chinuri faqt’ori qartul ek’onomik’ashi [Chinese Factor in the Georgian Economy].

Civil Georgia. (2020a, April 9). EU Allocates EUR 183 Mln to Support Georgia’s Needs amid Pandemic. https://civil.ge/archives/346244

Civil Georgia. (2020b, May 7). Georgia Unveils Tourism Stimulus Plan, Country to Reopen for Int’l Tourists in July. https://civil.ge/archives/350788

Civil Society Organisations. (2018a). Georgia on European Way: Creation of Effective Model for DCFTA and SME Strategy Implementation. Results of the DCFTA Related Mappings of Georgian SMEs and CSOs.

Civil Society Organisations. (2018b). Implementation of EU-georgia Association Agenda 2017-2020. Assessment by Civil Society (Issue December).

Daghelishvili, N. (2019). Why Can’t Georgia Take Full Advantage of Opportunities Provided by the Deep and Comprehensive Free Trade Area (DCFTA)? Georgian Institute of Politics. http://gip.ge/why-cant-georgia-take-full-advantage-of-opportunities-provided-by-the-deep-and-comprehensive-free-trade-area-dcfta/

DCFTA Action Plan 2020. (2020). In DCFTA Action Plan 2020. Procurement. gov.ge.

EU-Georgia Association Agreement Implementation Framework.Trade and Sustainable Development. Work Plan 2018-20. (2018). DCFTA.Gov.Ge.

Gambino, E. (2019). The Georgian logistics revolution: Questioning seamlessness across the New Silk Road. Work Organisation, Labour and Globalisation, 13(1), 190-206. https://doi.org/10.13169/workorgalaboglob.13.1.0190

Geostat. (2020). Gross Domestic Product of Georgia 2019. www.geostat.ge

Geostat. (2021). External Merchandise Trade in Georgia: January. www.geostat.ge

Green Alternative. (2010). sakhelmz’ghvanelo okros mop’ovebis zemokmedebis qvesh mkh’ofi mosakhleobisatvis [Manual for the population influenced by gold mining].

Green Alternative. (2013). madnueli k’anonze maghla [Mineral resources over law].

Green Alternative. (2018a). Georgian Manganese – k’omp’aniis p’ropili [Georgian Manganese – a profile of the company]. Green Alternative.

Green Alternative. (2018b). Saknakhshiri – k’omp’aniis p’ropili [Saknakhshiri – a profile of the company]. Green Alternative.

Green Alternative. (2021). Rich Metal Group RMG: Company Profile.

Gugushvili, D. (2016). Lessons from Georgia’s neoliberal experiment: A rising tide does not necessarily lift all boats. Communist and Post-Communist Studies, 50(1), 1-14.

Guruli, I. (2020). Georgia-EU Integration – Progress Made so far and Steps to Move Forward. Economic Policy Research Centre, Open Society Foundation Georgia. https://osgf.ge/en/publication/georgia-eu-integration-progress-made-so-far-and-steps-to-move-forward/

International Monetary Fund. (2020). Statement by IMF on Georgia. imf.org. https://www.imf.org/en/News/Articles/2020/03/30/pr20120-georgia-statement-by-imf

Janelidze, B., & Nakhutsrishvili, L. (2020). J’ami. nats’ili p’irveli: sagangebo mdgomareoba [Times. Part One: state of emergency]. Human Rights Education and Monitoring Center (EMC). https://socialjustice.org.ge/ka/products/zhami-natsili-pirveli-sagangebo-mdgomareoba

Kakulia, M., Kapanadze, N., & Qurkhuli, L. (2017). Kronik’uli sigharibe da shemosavlebis utanabroba sakartveloshi: ek’onomik’ur-st’at’ist’ik’uri k’vleva [Chronic poverty and income inequality in Georgia: economic-statistial research].

Khaliani, T., & Aptsiauri, S. (2014, May 1). shroma gadarchnistvis -nats’ili p’irveli [Working for survival - Part I]. Liberali. http://liberali.ge/articles/view/3578/shroma-gadarchenisatvis-natsili-pirveli

Khishtovani, G., Zabakhidze, M., Gabriadze, I., & Beradze, R. (2019). The Belt and Road Initiative in the South Caucasus Region (The Impact of the Belt and Road Initiative in Central Asia and the South Caucasus: “Inside-out” Perspectives of Experts from the Region).

Lazarus, J. (2013). Democracy or Good Governance? Globalization, Transnational Capital, and Georgia’s Neo-liberal Revolution. Journal of Intervention and Statebuilding, August, 1-28.

National Bank of Georgia. (2018). Annual report.

National Bank of Georgia. (2020a). Financial Sector Review: March.

National Bank of Georgia. (2020b). Financial Stability Report 2020.

National Bank of Georgia. (2020c). Gross external Debt of Georgia. nbg.gov.ge. https://www.nbg.gov.ge/index.php?m=340&newsid=3895

National Bank of Georgia. (2020d). Koba Gvenetadze – sakartvelo ikneba ert-erti p’irveli kvekh’ana, romelits saertashoriso savalut’o pondis mimdinare p’rogramis parglebshi gazrdil dakhmarebas miighebs [Koba Gvenetadze – Georgia will be one of the first countries to receive increased assist]. nbg.gov.ge. https://www.nbg.gov.ge/index.php?m=340&newsid=3912&lng=geo

National Statistics Office of Georgia. (2021). External Merchandise Trade of Georgia 2020 (preliminary results). https://www.geostat.ge/en/single-news/2016/external-merchandise-trade-of-georgia-in-2020-preliminary

Qeburia, T., & Devidze, M. (2020). okros tsieb-tskheleba da gloabluri p’andemia [Gold rush and global pandemic]. EMC. https://socialjustice.org.ge/ka/products/okros-tsieb-tskheleba-da-globaluri-pandemia

Sirbiladze, I. (2020). China-Georgia relations amid Georgia’s Western Path: An Emerging but Limited Partnership? (PMCG Research Center Policy Paper).

Social Service Agency. (2020). The Number of Registered Beneficiaries of Ttargeted Subsistence Allowance. ssa.gov.ge

Tsintsadze, G. (2021). EMC. Rbola Psk’erisk’en: Namakhvanhesis Khelshek’rulebis k’valdak’val [Race to the Bottom: Along the Contract of Namakhvani Hydropower Station]. https://socialjustice.org.ge/ka/products/rbola-fskerisken-namakhvanhesis-khelshekrulebis-kvaldakval

Tsuladze, Z. (2018, April 9). Tkh’ibuli – gamotskhadebuli sik’vdilis kalaki [Tkibuli – a city of death]. Voice of America. https://www.amerikiskhma.com/a/georgia-six-miners-killed-in-tkibuli-coal-mine/4339108.html

UNECE. (2018). Regulatory and Procedural Barriers to Trade in Georgia: Needs Assessment. In Regulatory and Procedural Barriers to Trade in Armenia. https://www.un-ilibrary.org/content/books/9789210042871

UNICEF. (2018). Mosakhleobis k’etildgheobis k’vleva 2017: mok’le mimokhilva [Population Welfare Research 2017: short overview]. https://www.un-ilibrary.org/content/books/9789210042871

Zhou, J. (2012). Chinese in Georgia Jiayi Zhou (No. 54; ECMI Workign Paper, Issue January). https://www.un-ilibrary.org/content/books/9789210042871

Reference list:

About 100,000 Georgian citizens lost their source of income during the pandemic. (2020, October 12). Agenda.ge. https://agenda.ge/en/news/2020/3167 (accessed June 10, 2021).

Asatiani, E. (2021, March 5). Namakhvani HPP – “dam of death” or critical energy security? JAM News. https://jam-news.net/namakhvani-hpp-dam-of-death-or-critical-energy-security/ (accessed June 10, 2021).

Bradsher, K. (2020, January 15). China Renews Its “Belt and Road” Push for Global Sway. The New York Times. https://www.nytimes.com/2020/01/15/business/china-belt-and-road.html (accessed June 10, 2021).

Caucasus Sustainable Energy Financing Facility. (n.d.). Green Economy Financing Facility – GEFF. https://ebrdgeff.com/seff_facilities/georgia-commercial/ (accessed June 10, 2021).

Chichua, N. (2019, June 12). Crossing US-China interests in Anaklia and Georgia. Netgatzi. https://netgazeti.ge/news/371236/ (accessed June 10, 2021).

Chipashvili, D., Kochladze, M. (2019, May). Namakhvani hydropower project. Green Alternative & CEE Bankwatch Network. Issue Paper. http://greenalt.org/wp-content/uploads/2019/05/Issue_Paper_new_Namakhvani_2019.pdf (accessed June 10, 2021).

ENPARD. (n.d.). The European Union for Georgia. https://eu4georgia.ge/enpard/ (accessed June 10, 2021).

Enterprise Georgia. (n.d.). http://www.enterprisegeorgia.gov.ge/en/home (accessed June 10, 2021).

EU-China 2020 Strategic Agenda for Cooperation. (2020, November 23). Delegation of the European Union to China. https://eeas.europa.eu/delegations/china_bs/15398/EU-China%202020%20Strategic%20Agenda%20for%20Cooperation (accessed June 10, 2021).

EU4Energy: South Caucasus Sustainable Energy Finance Facility. (n.d.). EU Neighbours East. https://www.euneighbours.eu/en/east/stay-informed/projects/eu4energy-south-caucasus-sustainable-energy-finance-facility (accessed June 10, 2021).

Foreign Direct Investment, net inflows (% of GDP) (n.d.) The World Bank, https://data.worldbank.org/indicator/BX.KLT.DINV.WD.GD.ZS?locations=GE (accessed June, 10 2021).

Gambino, E. (2020, January 17). Logistical Nightmares: what can we learn from the crisis of Anaklia Deep Sea Port. First Channel. https://1tv.ge/analytics/logistical-nightmares-what-can-we-learn-from-the-crisis-of-anaklia-deep-sea-port/ (accessed June 10, 2021).

Gaprindashvili, P., Tsitsikashvili, M. (2019, July 17). Op-Ed: “Anaklia Deep-Sea Port – too Important for Georgia and the West to Lose”. Institut für Europäische Politik. http://iep-berlin.de/en/op-ed-anaklia-deep-sea-port-too-important-for-georgia-and-the-west-to-lose/ (accessed June 10, 2021).

Georgia Hazardous Waste. (n.d.). The European Union for Georgia. https://eu4georgia.ge/georgia-hazardous-waste/ (accessed June 10, 2021).

Giorgi Gakharia: We will visit all the companies that did not pay their employees for several months (2020, April 14). Commersant. https://commersant.ge/ge/post/giorgi-gaxaria-mivakitxavt-yvela-kompanias-romelmac-dasaqmebuls-ramdenime-tvis-anazgaureba-ar-gadauxada (accessed June 10, 2021).

Graupner, H. (2018, December 6). Mining in Tkibuli: Death is never far awaying. Deutsche Welle. https://www.dw.com/en/mining-in-tkibuli-death-is-never-far-away/g-46616556 (accessed June 10, 2021).

Green Economy: Sustainable Mountain Tourism and Organic Agriculture (GRETA). (n.d.). The European Union for Georgia. https://eu4georgia.ge/green-economy-sustainable-mountain-tourism-and-organic-agriculture-greta/ (accessed June 10, 2021).

Gross Domestic Product of Georgia 2019. (2020). Geostat. https://www.geostat.ge/en/modules/categories/23/gross-domestic-product-gdp (accessed June 10 2021).

Kincha, S. (2021, March 1). Thousands turn out for Kutaisi hydropower protest. OC Media. https://oc-media.org/thousands-turn-out-for-kutaisi-hydropower-protest/ (accessed June 10, 2021).

Kvanchilashvili, E. (2020, November 12). IMF: In 2021, Georgia’s public debt will be 62 percent of GDP. Business Media Georgia. https://bm.ge/ka/article/imf-2021-wels-saqartvelos-saxelmwifo-vali-mshp-is-62-iqneba/68581 (accessed June 10, 2021).

Ma, D. (2016, March 12). Can China Avoid the Middle Income Trap? Foreign Policy. https://foreignpolicy.com/2016/03/12/can-china-avoid-the-middle-income-trap-five-yearplan-economy-two-sessions/ (accessed June 10, 2021).

Matitashvili, M. (2020, June 9). A worker fell from the construction site in Marneuli and died. Publika. მარნეულში მშენებარე კორპუსიდან მუშა გადმოვარდა და ადგილზე გარდაიცვალა (publika.ge) (accessed June 10, 2021).

McBridge, J., Chatzky, A. (2019, May 13). Is “Made in China 2025” a Threat to Global Trade? Council on Foreign Relations. https://www.cfr.org/backgrounder/made-china-2025-threat-global-trade (accessed June 10, 2021).

McBridge, J., Chatzky, A. (2020, January 28). China’s Massive Belt and Road Initiative. Council on Foreign Relations. https://www.cfr.org/backgrounder/chinas-massive-belt-and-road-initiative (accessed June 10, 2021).

National Bank of Georgia (2021, April) Monetary Policy Report, https://www.nbg.gov.ge/uploads/publications/moneratyfiscal/2021/2021q2_eng.pdf (accessed June 17, 2021).

National Statistics Office of Georgia (2021, May 18) Indicators of the Labour Force, Employment and Unemployment 2020, https://www.geostat.ge/media/38207/Indicators-of-the-Labour-Force---Indicators-of-the-Labour-Force---2020.pdf (accessed June 19, 2021).

Nenskra HPP. (n.d.). European Bank for Reconstruction and Development. https://www.ebrd.com/work-with-us/projects/psd/nenskra-hpp.html (accessed June 10, 2021).

Nenskra hydropower plant, Georgia. (n.d.). CEE Bankwatch Network. https://bankwatch.org/project/nenskra-hydropower-plant-georgia?gclid=Cj0KCQiAyJOBBhDCARIsAJG2h5eqdYpsrxBH4H31dGjlfCWkRY0m4Kre8MskC4fYlqK6Wq8CCjLeSmgaAq99EALw_wcB (accessed June 10, 2021).

Parulava, D. (2019, May 28). Speaking up through sewn lips: a wildcat strike in Chiatura. OC Media. https://oc-media.org/features/speaking-up-through-sewn-lips-a-wildcat-strike-in-chiatura/ (accessed June 10, 2021).

Pertaia, L. (2020, July 10). Who and why is lobbying for labor reform in Parliament. Netgazeti. https://netgazeti.ge/news/466725/(accessed June 10, 2021).

Polish Ambassador to Georgia: Surprising – Georgia cooperates with China with EU money (2020, December 6). Radio Liberty. https://www.radiotavisupleba.ge/a/30986570.html (accessed June 10, 2021).

Projects Summary Documents. (2021). European Bank for Reconstruction and Development. https://www.ebrd.com/work-with-us/project-finance/project-summary-documents.html?1=1&filterCountry=Georgia (accessed June 10, 2021).

Protests Against Namakhvani HPP Continue Despite Police Dispersal. (2020, November 16). Civil.ge. https://www.mof.ge/en/4409 (accessed June 10, 2021).

Public Debt. (n.d.). Ministry of Finance of Georgia. https://www.mof.ge/en/4409 (accessed June 10, 2021).

Shuakhevi hydropower plant, Georgia. (n.d.). CEE Bankwatch Network. https://bankwatch.org/project/shuakhevi-hydropower-plant-georgia (accessed June 10, 2021).

Startup Georgia. (n.d.). http://startup.gov.ge/geo/home (accessed June 10, 2021).

Tkeshelashvili, S. (2020, May 10). Which 400 companies does Georgia offer to export production from China? Business Media Georgia. https://bm.ge/ka/article/romel-400-kompanias-stavazobs-saqartvelo-chinetidan-warmoebis-gadmotanas/56001 (accessed June 10, 2021).

“Today the Labor Code is only on paper” – what are the obligations under the Association Agreement of Georgia. (2020, July 13). Publika. https://publika.ge/dghes-shromis-kodeqsi-mkholod-furcelzea-ra-valdebulebebi-aqvs-saqartvelos-asocirebis-khelshekrulebit/ (accessed June 10, 2021).

Vardiashivili, M. (2019, May 2). Why Georgia’s hydropower plants are causing nation-wide protests. JAM News. https://jam-news.net/why-georgias-hydropower-plants-are-causing-nation-wide-protests/ (accessed June 10, 2021).

What was lost when a mining company destroyed the ancient Sakdrisi site? (2015, September 8), Democracy and Freedom Watch. https://dfwatch.net/what-was-lost-when-a-mining-company-destroyed-the-ancient-sakdrisi-site-38139 (accessed June 10, 2021).

Zalan, E. (2017, December 21). EU defends new trade rules after Chinese criticism. EUobserver. https://euobserver.com/eu-china/140392 (accessed June 10, 2021).